Introduction to Fintech App Development

In today's rapidly evolving digital landscape, the financial technology (Fintech) sector is experiencing unprecedented growth. Mobile applications are at the forefront of this transformation, providing consumers and businesses with convenient, accessible, and efficient ways to manage their finances. Selecting the right fintech app development company is critical for success. This article explores the key aspects of fintech app development, highlighting the challenges, opportunities, and best practices involved in creating secure and innovative financial applications.

The demand for innovative financial solutions continues to surge, driving the need for sophisticated and user-friendly mobile applications. From mobile banking and investment platforms to payment gateways and personal finance management tools, fintech apps are reshaping the financial industry. But with this growth comes increased scrutiny and the need for robust security measures and compliance with stringent regulations. Working with an experienced fintech app development partner ensures your app is both cutting-edge and compliant.

Why Choose a Specialized Fintech App Development Company?

While general mobile app developers can build apps, the fintech industry presents unique challenges that require specialized expertise. Choosing a fintech app development company offers several key advantages:

- Deep Understanding of Financial Regulations: Fintech companies operate under strict regulatory frameworks, such as GDPR, PCI DSS, and PSD2. A specialized developer understands these regulations and ensures your app complies with all relevant requirements.

- Focus on Security: Security is paramount in the financial industry. Fintech app developers implement robust security measures to protect sensitive financial data and prevent fraud. They are well-versed in techniques such as data encryption, multi-factor authentication, and vulnerability testing.

- Expertise in Fintech Technologies: Fintech apps often require integration with complex systems and APIs. A specialized developer possesses the technical skills and experience to seamlessly integrate your app with existing financial infrastructure.

- Industry Best Practices: Fintech development companies stay abreast of the latest industry trends and best practices, ensuring your app is competitive and meets the evolving needs of your target audience.

- Reduced Development Time and Costs: Their focused expertise can often translate to quicker development times and therefore, lower costs.

Key Considerations in Fintech App Development

Developing a successful fintech app requires careful planning and execution. Here are some key considerations to keep in mind:

1. Defining Your Target Audience and App Purpose

Before starting development, clearly define your target audience and the specific problem your app aims to solve. Understanding your user base is crucial for designing an app that meets their needs and expectations. Conduct thorough market research to identify user pain points and unmet needs. This research will inform the features and functionality of your app. Consider developing detailed user personas to represent your ideal users and guide the design process.

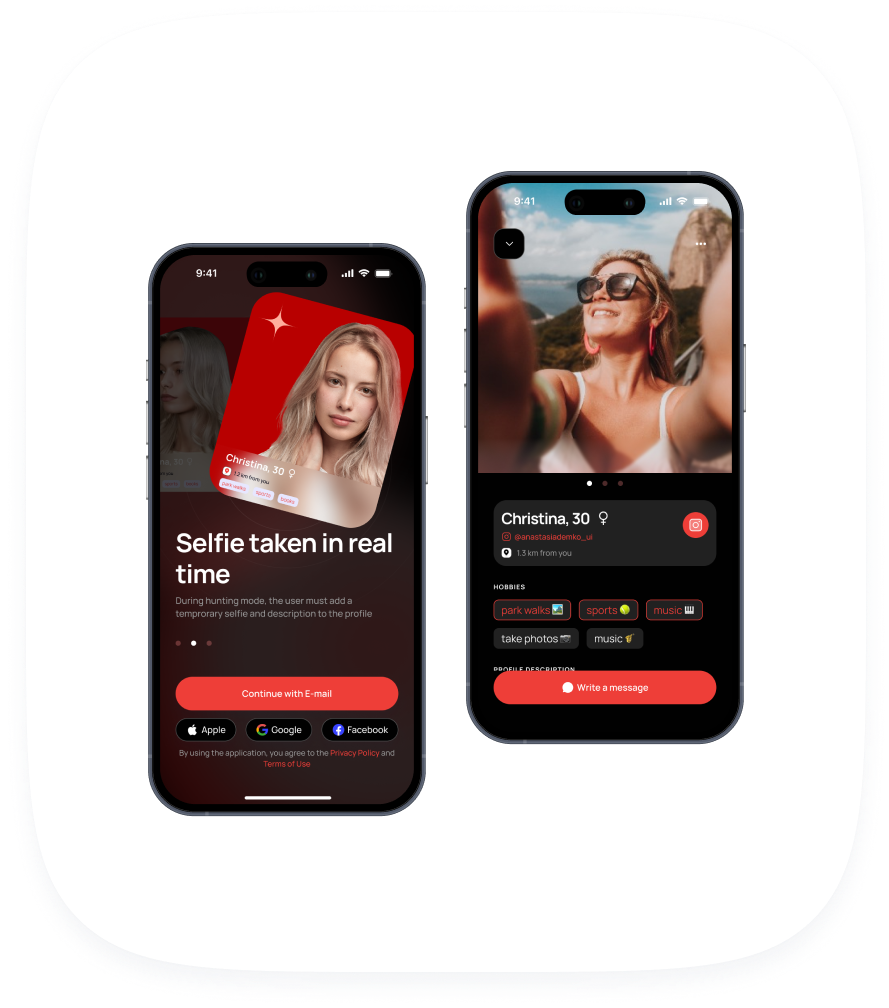

2. User Experience (UX) and User Interface (UI) Design

A user-friendly interface is essential for attracting and retaining users. Fintech apps should be intuitive, easy to navigate, and visually appealing. Invest in professional UX/UI design to create a seamless and enjoyable user experience. Focus on simplicity and clarity. Minimize the number of steps required to complete key tasks. Conduct user testing throughout the development process to gather feedback and identify areas for improvement. A positive UX is directly correlated with increased user engagement and retention.

3. Security and Compliance

Security and compliance are non-negotiable aspects of fintech app development. Implement robust security measures to protect sensitive data from cyber threats. Ensure your app complies with all relevant regulations, such as GDPR, PCI DSS, and PSD2. Conduct regular security audits and penetration testing to identify and address vulnerabilities. Data encryption, multi-factor authentication, and secure data storage are essential security features. Work closely with legal experts to ensure ongoing compliance with evolving regulations.

4. Technology Stack

Choosing the right technology stack is crucial for building a scalable and reliable fintech app. Consider factors such as performance, security, and maintainability when selecting your technology stack. Popular technologies for fintech app development include:

- Programming Languages: Java, Swift, Kotlin, Python, JavaScript

- Frameworks: React Native, Flutter, Angular

- Databases: PostgreSQL, MySQL, MongoDB

- Cloud Platforms: AWS, Azure, Google Cloud

- Security Libraries: OpenSSL, Bouncy Castle

5. Integration with Existing Systems

Fintech apps often need to integrate with existing financial systems and APIs. Ensure your app can seamlessly integrate with these systems to provide a smooth user experience. Consider using APIs provided by banks, payment processors, and other financial institutions. Thoroughly test all integrations to ensure data accuracy and security. API management platforms can help streamline the integration process.

6. Testing and Quality Assurance

Rigorous testing and quality assurance are essential for identifying and fixing bugs and ensuring the app meets performance and security standards. Conduct thorough testing throughout the development process, including unit testing, integration testing, and user acceptance testing. Automate testing processes to improve efficiency and accuracy. Pay particular attention to security testing to identify and address vulnerabilities. Continuous integration and continuous delivery (CI/CD) pipelines can help automate the testing and deployment process.

7. Scalability and Performance

As your user base grows, your app needs to be able to handle increased traffic and data volume. Design your app with scalability in mind. Optimize performance to ensure a smooth and responsive user experience. Use cloud-based infrastructure to easily scale resources as needed. Load testing can help identify performance bottlenecks. Caching strategies can improve response times and reduce server load.

8. Maintenance and Support

Ongoing maintenance and support are crucial for ensuring the long-term success of your app. Provide regular updates to address bugs, add new features, and improve security. Offer timely and responsive customer support to address user issues and concerns. Monitor app performance and proactively address any issues that arise. Consider offering different levels of support to meet the needs of different users.

Types of Fintech Apps

The fintech landscape encompasses a diverse range of applications, each catering to specific financial needs. Understanding these different types can help you identify the market opportunity and the features required for your app.

Mobile Banking Apps

Mobile banking apps allow users to manage their bank accounts, transfer funds, pay bills, and access other banking services from their smartphones. These apps typically offer features such as account balance viewing, transaction history, mobile check deposit, and ATM locators. Security is paramount, with features such as multi-factor authentication and biometric login.

Payment Apps

Payment apps facilitate mobile payments, allowing users to send and receive money, make purchases, and pay bills using their smartphones. Popular payment apps include PayPal, Venmo, and Square Cash. These apps often integrate with debit cards, credit cards, and bank accounts. Security features such as encryption and fraud detection are critical.

Investment Apps

Investment apps allow users to invest in stocks, bonds, mutual funds, and other financial instruments from their smartphones. These apps often offer features such as real-time quotes, portfolio tracking, and educational resources. Popular investment apps include Robinhood, Acorns, and Fidelity Investments. Regulatory compliance is a key consideration.

Personal Finance Management Apps

Personal finance management apps help users track their spending, budget their money, and save for their financial goals. These apps often offer features such as budgeting tools, spending trackers, and financial calculators. Mint and Personal Capital are examples of popular personal finance management apps. Data privacy and security are essential.

Cryptocurrency Apps

Cryptocurrency apps allow users to buy, sell, and store cryptocurrencies such as Bitcoin and Ethereum. These apps often offer features such as cryptocurrency wallets, trading platforms, and price trackers. Coinbase and Binance are popular cryptocurrency apps. Security and regulatory compliance are critical considerations.

The Future of Fintech App Development

The future of fintech app development is bright, with continued innovation and growth expected in the coming years. Emerging technologies such as artificial intelligence (AI), blockchain, and cloud computing are transforming the financial industry. AI is being used to automate tasks, personalize customer experiences, and detect fraud. Blockchain is enabling secure and transparent transactions. Cloud computing is providing scalable and cost-effective infrastructure. The adoption of these technologies will continue to drive innovation in fintech app development.

Furthermore, the increasing adoption of mobile payments and the growing demand for personalized financial services are driving the need for innovative fintech apps. As technology evolves, fintech app development companies must stay ahead of the curve to deliver cutting-edge solutions that meet the evolving needs of consumers and businesses.

The Role of AI in Fintech App Development

Artificial Intelligence (AI) is rapidly transforming the fintech industry, offering numerous benefits for app development and user experience.

AI-Powered Chatbots

AI-powered chatbots can provide instant customer support, answer questions, and resolve issues. These chatbots can handle a large volume of inquiries, freeing up human agents to focus on more complex tasks.

Fraud Detection

AI algorithms can analyze transaction data in real-time to detect fraudulent activity. These algorithms can identify patterns and anomalies that indicate fraud, helping to prevent financial losses.

Personalized Financial Advice

AI can analyze user data to provide personalized financial advice and recommendations. This can help users make informed decisions about their finances and achieve their financial goals.

Automated Underwriting

AI can automate the underwriting process, making it faster and more efficient. This can help lenders assess risk and make lending decisions more quickly.

Blockchain Technology in Fintech

Blockchain technology offers several potential benefits for the fintech industry, including increased security, transparency, and efficiency.

Secure Transactions

Blockchain can be used to create secure and transparent transaction systems. Transactions are recorded on a distributed ledger, making them tamper-proof and auditable.

Smart Contracts

Smart contracts are self-executing contracts that are stored on the blockchain. These contracts can automate complex financial transactions, reducing the need for intermediaries.

Digital Identity

Blockchain can be used to create secure digital identities, making it easier for individuals and businesses to verify their identities online.

Supply Chain Finance

Blockchain can be used to improve supply chain finance, making it easier for businesses to access financing and manage their supply chains.

Choosing the Right Fintech App Development Partner

Selecting the right fintech app development company is a crucial decision that can significantly impact the success of your project. Here are some key factors to consider when choosing a partner:

Experience and Expertise

Look for a company with extensive experience in developing fintech apps. They should have a deep understanding of the financial industry, relevant regulations, and the latest technologies. Review their portfolio to see examples of their past work and assess their capabilities.

Security Focus

Security should be a top priority. Ensure the company has a strong security focus and implements robust security measures to protect your data. Ask about their security protocols, penetration testing procedures, and compliance certifications.

Communication and Collaboration

Effective communication and collaboration are essential for a successful project. Choose a company that communicates clearly and proactively, and that is responsive to your needs. They should be willing to work closely with you throughout the development process.

Agile Development Methodology

An agile development methodology can help ensure that your project stays on track and that you have the flexibility to make changes as needed. Ask about their development process and how they manage changes and feedback.

Cost and Budget

Get a clear understanding of the costs involved in developing your app and ensure that the company offers a competitive price. However, don't let price be the only factor. Consider the value they bring to the table and their track record of success.

Table: Comparison of Fintech App Development Approaches

| Approach | Advantages | Disadvantages | Best Suited For |

|---|---|---|---|

| In-House Development | Full control, deep understanding of business needs | High initial costs, requires specialized expertise, longer development time | Large organizations with significant resources and specific needs |

| Outsourcing to a Specialized Fintech App Development Company | Access to specialized expertise, faster development time, cost-effective | Less direct control, potential communication barriers | Startups and SMEs seeking cost-effective and efficient development |

| Hybrid Approach | Combines the benefits of both in-house and outsourcing | Requires careful management and coordination | Organizations seeking a balance between control and expertise |

Conclusion: Partnering for Success in Fintech App Development

Fintech app development presents both significant opportunities and complex challenges. By understanding the key considerations, choosing the right fintech app development company, and embracing emerging technologies, you can create secure, innovative, and successful financial applications. Prioritize security, user experience, and regulatory compliance to build trust with your users and achieve long-term success in the rapidly evolving fintech landscape. The right partnership will allow you to capitalize on the burgeoning demand for secure and innovative mobile financial solutions.